In today’s digital age, acquiring business insurance online has become a prevalent choice for many entrepreneurs and small business owners. The convenience, accessibility, and often competitive pricing make it an attractive option. However, the question remains: can you truly obtain the best business insurance online? This article delves into this inquiry, exploring the advantages and potential drawbacks, and providing insights to help you make an informed decision.

Key Takeaways

- Online business insurance offers convenience and potential cost savings.

- It’s crucial to assess policy customization, insurer reputation, and customer support when choosing an online provider.

- While online platforms provide valuable tools, personalized advice may be beneficial for complex insurance needs.

- Thorough research and comparison are key to obtaining the best business insurance online.

What Makes the Best Business Insurance Online?

When searching for business insurance online, it’s important to look beyond just the price. The “best” insurance means it fits your business’s unique needs, offers solid protection, and gives you peace of mind. Here are the key factors that make a business insurance policy stand out online:

Comprehensive and Relevant Coverage

The best business insurance online offers policies that cover all the risks your business might face. Different businesses have different exposures, so your insurance should reflect that.

- General Liability: Protects against claims like bodily injury, property damage, or advertising mistakes.

- Professional Liability: For businesses offering advice or services, it covers claims of negligence.

- Commercial Property: Covers your physical assets against fire, theft, or natural disasters.

- Workers’ Compensation: Mandatory in most places if you have employees; covers workplace injuries.

- Cyber Liability: Covers data breaches or cyber-attacks—especially crucial for online or tech businesses.

A good online provider will allow you to bundle these or pick what’s relevant to you.

Customization and Flexibility

No two businesses are exactly alike. The best online business insurance allows you to customize your policy easily:

- Choose coverage limits that suit your risk exposure.

- Add or remove endorsements specific to your industry.

- Tailor deductibles to balance premiums and out-of-pocket costs.

Look for platforms with interactive tools or online agents who can help you tailor the policy.

Competitive Pricing

One of the biggest draws of business insurance online is the potential for cost savings:

- Online platforms cut out middlemen, so premiums can be more competitive.

- Easy comparison tools help you see which policies offer the best value.

- Discounts for bundling multiple coverages or for business safety practices.

But remember, the cheapest option isn’t always the best. Balance price with coverage quality.

Reputable and Financially Stable Insurers

Buying insurance online doesn’t mean you should compromise on reliability. The best business insurance online comes from insurers who:

- Have strong financial ratings (e.g., from AM Best, Moody’s).

- Possess positive customer reviews.

- Are licensed and regulated in your state or country.

Platforms that partner only with trusted insurers provide peace of mind that claims will be paid promptly.

Simple and Transparent Online Process

A top-notch online insurance experience means:

- Instant or very fast quotes.

- Clear explanations of what is and isn’t covered.

- Easy online application and policy management.

- Digital ID cards and documentation.

- Online claims filing and tracking.

The process should be intuitive, quick, and free of confusing jargon.

Responsive Customer Support

Even with an online purchase, you’ll want access to knowledgeable support:

- Live chat, phone, or email assistance.

- Help with choosing the right coverage.

- Guidance during claims.

- Post-sale service for policy updates.

The best providers combine digital convenience with human expertise when needed.

Positive Customer Feedback and Trustworthiness

Before buying, check:

- Customer reviews on independent sites.

- How claims are handled (speed, fairness).

- Any recurring complaints or red flags.

Platforms with consistent high ratings and happy customers are more likely to offer the best business insurance online.

Summary

The best business insurance online combines comprehensive coverage, customization, competitive pricing, trusted insurers, and an easy-to-use platform backed by excellent customer service. When these pieces come together, you get insurance that fits your business well, protects you adequately, and can be purchased without hassle—all from your computer or phone.

Examples of Best Business Insurance Online

Hiscox

- Why it’s great: Hiscox is known for its specialized business insurance policies designed specifically for small businesses and freelancers. They offer easy online quotes and flexible policies including general liability, professional liability, and cyber insurance.

- Highlights: Instant quotes, customization options, strong reputation for handling claims fairly.

- Best for: Small businesses, consultants, and online professionals.

Next Insurance

- Why it’s great: Next Insurance is a digital-first insurer focused entirely on small business insurance online. Their platform is designed for quick quotes, tailored coverage, and easy purchase processes.

- Highlights: Fast, user-friendly online platform; insurance for hundreds of industries; affordable premiums.

- Best for: Small to medium-sized businesses wanting a fast, hassle-free process.

CoverWallet

- Why it’s great: CoverWallet acts as a marketplace that connects businesses with multiple insurance providers. It helps you compare quotes and coverage side-by-side online.

- Highlights: Wide selection of insurers; robust comparison tools; expert guidance available.

- Best for: Businesses that want to shop around and compare policies before buying.

The Hartford

- Why it’s great: The Hartford is a long-established insurer offering a wide range of business insurance policies online. Their platform caters to small businesses but also supports larger enterprises.

- Highlights: Strong customer service; comprehensive coverage options; financial strength.

- Best for: Businesses looking for trusted insurance companies with online access.

Simply Business

- Why it’s great: Simply Business provides an easy-to-use online platform tailored to small businesses, allowing them to get quotes and buy insurance quickly.

- Highlights: Fast online quotes; coverage for a variety of industries; simple policy management.

- Best for: Small businesses and startups seeking simple and straightforward insurance.

Progressive Commercial

- Why it’s great: Known for auto insurance, Progressive also offers business insurance online, especially good for businesses that rely heavily on vehicles.

- Highlights: Specialized commercial auto insurance; bundling options; easy online quotes.

- Best for: Businesses with fleets or commercial vehicles.

Embroker

- Why it’s great: Embroker is a tech-driven insurance platform offering tailored business insurance online with a focus on transparency and digital management.

- Highlights: Customized policies; digital dashboards for policy management; strong in technology and startups insurance.

- Best for: Tech startups and companies wanting innovative online insurance solutions.

Why These Are Considered the Best Business Insurance Online

- Convenience: They provide instant or fast online quotes and easy digital purchasing.

- Customization: Their platforms allow tailoring coverage to specific business needs.

- Reputation: They have strong customer reviews and are financially reliable.

- Support: Even online, they offer solid customer service for questions or claims.

Why Buy Business Insurance Online?

The digital transformation has touched almost every industry — and insurance is no exception. Purchasing business insurance online offers distinct advantages over traditional methods like in-person meetings or phone calls. Here’s why more and more businesses are turning to online insurance platforms:

Convenience and Speed

One of the biggest reasons to buy business insurance online is the convenience. You can:

- Get quotes instantly at any time—no need to wait for business hours or schedule appointments.

- Compare different policies side-by-side from multiple insurers in just minutes.

- Purchase and manage your policy right from your computer, tablet, or smartphone.

- Avoid piles of paperwork and long waiting times.

This speed and convenience allow busy business owners to focus more on running their companies and less on hunting for insurance.

Better Pricing and Cost Transparency

Online insurance platforms often offer more competitive pricing because they:

- Cut out middlemen like brokers or agents, reducing commission costs.

- Allow you to see upfront how premiums change based on coverage limits and deductibles.

- Enable you to compare prices across different insurers easily to find the best deal.

This transparency helps you avoid surprise costs and find affordable insurance tailored to your budget.

Access to More Options

When you buy business insurance online, you aren’t limited to a single insurer’s offerings. Instead, you get access to:

- Multiple insurance companies in one place.

- A variety of policy types and coverage levels.

- Specialty policies for niche industries (e.g., tech, retail, contractors).

This wide range of options makes it easier to find coverage that matches your business’s unique risks.

Customization Made Easy

Many online platforms provide interactive tools and guided questionnaires that help you customize your insurance policies to suit your exact needs.

- Adjust coverage limits.

- Add or remove endorsements.

- Bundle different types of insurance in one package.

This level of control ensures you pay only for the coverage you need.

Transparency and Education

Online platforms often include:

- Detailed descriptions of coverage options.

- FAQs, blogs, and guides to help you understand insurance jargon.

- Customer reviews and ratings.

This transparency empowers you to make well-informed decisions rather than relying solely on an agent’s advice.

Efficient Claims Process

Many online insurers have digital claims filing systems that allow you to:

- Submit claims quickly online.

- Track the status of claims in real-time.

- Upload documents and photos digitally.

This streamlined process can lead to faster resolutions and less hassle during stressful situations.

Suits Small and New Businesses

Startups and small businesses often have tight budgets and limited time. Online insurance makes it easier and more affordable for these businesses to:

- Get coverage quickly.

- Adjust policies as they grow.

- Manage policies without needing a dedicated insurance specialist.

Convenience and Speed

One of the biggest reasons to buy business insurance online is the convenience. You can:

- Get quotes instantly at any time—no need to wait for business hours or schedule appointments.

- Compare different policies side-by-side from multiple insurers in just minutes.

- Purchase and manage your policy right from your computer, tablet, or smartphone.

- Avoid piles of paperwork and long waiting times.

This speed and convenience allow busy business owners to focus more on running their companies and less on hunting for insurance.

Better Pricing and Cost Transparency

Online insurance platforms often offer more competitive pricing because they:

- Cut out middlemen like brokers or agents, reducing commission costs.

- Allow you to see upfront how premiums change based on coverage limits and deductibles.

- Enable you to compare prices across different insurers easily to find the best deal.

This transparency helps you avoid surprise costs and find affordable insurance tailored to your budget.

Access to More Options

When you buy business insurance online, you aren’t limited to a single insurer’s offerings. Instead, you get access to:

- Multiple insurance companies in one place.

- A variety of policy types and coverage levels.

- Specialty policies for niche industries (e.g., tech, retail, contractors).

This wide range of options makes it easier to find coverage that matches your business’s unique risks.

Customization Made Easy

Many online platforms provide interactive tools and guided questionnaires that help you customize your insurance policies to suit your exact needs.

- Adjust coverage limits.

- Add or remove endorsements.

- Bundle different types of insurance in one package.

This level of control ensures you pay only for the coverage you need.

Transparency and Education

Online platforms often include:

- Detailed descriptions of coverage options.

- FAQs, blogs, and guides to help you understand insurance jargon.

- Customer reviews and ratings.

This transparency empowers you to make well-informed decisions rather than relying solely on an agent’s advice.

Efficient Claims Process

Many online insurers have digital claims filing systems that allow you to:

- Submit claims quickly online.

- Track the status of claims in real-time.

- Upload documents and photos digitally.

This streamlined process can lead to faster resolutions and less hassle during stressful situations.

Suits Small and New Businesses

Startups and small businesses often have tight budgets and limited time. Online insurance makes it easier and more affordable for these businesses to:

- Get coverage quickly.

- Adjust policies as they grow.

- Manage policies without needing a dedicated insurance specialist.

Summary

Buying business insurance online offers unmatched convenience, competitive pricing, a wide range of options, and transparency. It empowers you to make faster, better-informed decisions that protect your business without the traditional headaches. Whether you’re a small startup or an established company, online insurance platforms give you control and flexibility — all from the comfort of your desk or smartphone.

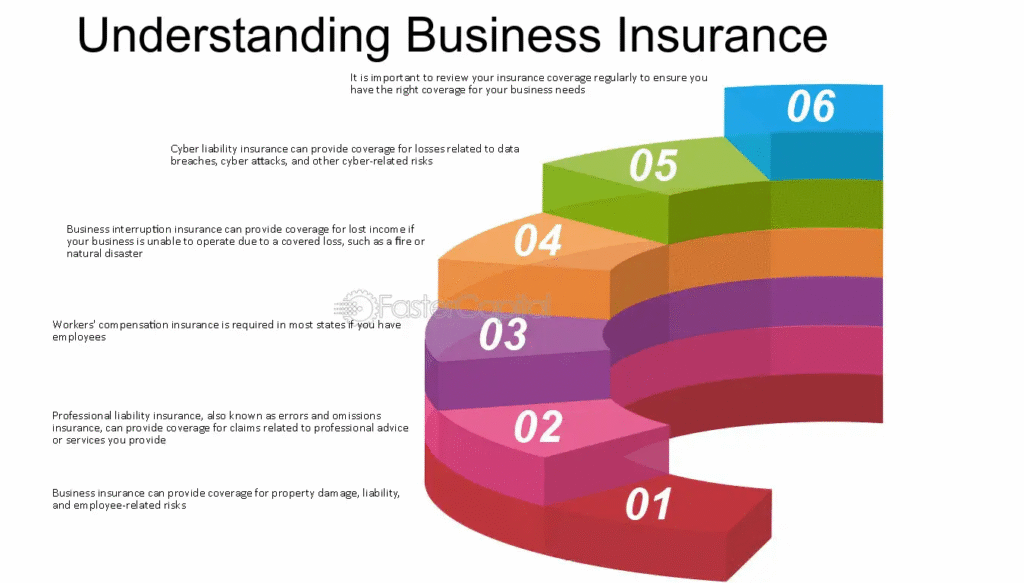

Understanding Business Insurance

Business insurance is a vital tool that protects businesses from various risks, including property damage, legal liabilities, and employee-related risks. It encompasses a range of policies tailored to the specific needs of a business, such as:

- General Liability Insurance: Covers legal fees and damages arising from third-party claims of bodily injury or property damage.

- Professional Liability Insurance: Protects against claims of negligence or malpractice in professional services.

- Workers’ Compensation Insurance: Provides compensation to employees who suffer work-related injuries or illnesses.

- Commercial Property Insurance: Covers damage to business property due to events like fire, theft, or natural disasters.

- Cyber Liability Insurance: Protects against data breaches and cyber-attacks.

The Rise of Online Business Insurance

The advent of online platforms has revolutionized the insurance industry. Traditional methods of purchasing insurance often involved lengthy paperwork, in-person meetings, and reliance on agents. Online insurance platforms have streamlined this process, offering:

- Convenience: Businesses can obtain quotes, compare policies, and purchase insurance at any time and from anywhere.

- Cost-Effectiveness: Direct dealings with insurers online can eliminate agent commissions and overhead costs, potentially leading to lower premiums.

- Transparency: Online platforms often provide detailed information, customer reviews, and comparison tools, empowering businesses to make informed choices.

Evaluating the Quality of Online Business Insurance

While the benefits of online business insurance are evident, it’s crucial to assess whether the best coverage is available through these platforms. Consider the following factors:

- Policy Customization: Ensure that the online platform offers policies that can be tailored to your business’s specific needs. Generic policies may not provide adequate coverage for unique risks.

- Reputation of Insurers: Research the credibility and financial stability of insurers available online. Established companies with strong reputations may offer more reliable coverage.

- Customer Support: Evaluate the quality of customer service provided. Accessible support is essential for addressing queries and resolving issues promptly.

- Claims Process: Investigate the efficiency and transparency of the claims process. A straightforward and responsive claims procedure is vital during challenging times.

Advantages of Purchasing Business Insurance Online

Opting for online business insurance presents several advantages:

- Time Efficiency: The online process is typically faster, with many platforms offering instant quotes and policy issuance.

- Accessibility: Businesses can access a wide range of insurers and policies without geographical constraints.

- Comparative Analysis: Online tools allow for easy comparison of different policies, helping businesses select the most suitable option.

Potential Drawbacks to Consider

Despite the advantages, there are potential drawbacks to purchasing business insurance online:

- Lack of Personalized Advice: Without an agent’s guidance, businesses may miss out on expert recommendations tailored to their specific needs.

- Overwhelming Choices: The multitude of options available online can be daunting, leading to decision fatigue.

- Limited Face-to-Face Interaction: Some businesses may prefer in-person discussions to fully understand policy details and implications.

Making an Informed Decision

To determine if online business insurance is the best fit for your company:

- Assess Your Needs: Clearly define the risks your business faces and the coverage required.

- Research Providers: Investigate various online insurers, their offerings, and customer feedback.

- Utilize Comparison Tools: Leverage online comparison platforms to evaluate different policies and premiums.

- Consult Professionals: If necessary, seek advice from insurance brokers or industry experts to guide your decision.

Also Read: Can You Really Get the Best Business Insurance Online?

Conclusion

In conclusion, obtaining business insurance online can be an excellent choice for many businesses, offering convenience, cost savings, and a broad range of options. However, it’s essential to conduct thorough research and consider your company’s unique needs to ensure you select the best coverage. By evaluating the factors mentioned above and making informed decisions, you can secure the appropriate insurance to protect your business’s future.

FAQs

- Is online business insurance cheaper than traditional methods?

- Online platforms often eliminate agent commissions and overhead costs, potentially leading to lower premiums.

- Can I customize my policy when purchasing online?

- Many online insurers offer customizable policies to suit your business’s specific needs.

- How do I know if an online insurer is reputable?

- Research customer reviews, financial stability ratings, and industry accreditations to assess an insurer’s credibility.

- What should I do if I need assistance during the claims process?

- Contact the insurer’s customer support team for guidance and support throughout the claims process.

- Are there any risks associated with purchasing insurance online?

- Potential risks include lack of personalized advice and overwhelming choices; thorough research can mitigate these concerns.

- Can I switch from a traditional insurance provider to an online one?

- Yes, but ensure there is no coverage gap during the transition and that the new policy meets your needs.

- Is online business insurance suitable for all types of businesses?

- While many businesses can benefit from online insurance, those with complex needs may require personalized consultation.