Life insurance is often regarded as a cornerstone of financial planning, offering a safety net for loved ones in the event of an untimely demise. However, merely having a life insurance policy does not guarantee comprehensive protection. To ensure that your policy provides the intended security, it’s crucial to delve deeper into its specifics, understand its nuances, and regularly assess its adequacy.

Key Takeaways

- Life insurance provides financial protection for your loved ones in the event of your death.

- There are two main types: term life insurance and permanent life insurance.

- The right coverage depends on your personal and financial goals.

- Start early to get the best rates and policy options.

- Review your policy regularly and update it with any major life changes.

Understanding Life Insurance

Life insurance is one of the most important components of a comprehensive financial plan. While often overlooked or misunderstood, it plays a critical role in ensuring that your loved ones are protected financially if something were to happen to you. Whether you’re just starting to explore your options or looking to review an existing policy, gaining a solid understanding of how insurance works can help you make better, more informed decisions.

At its core, insurance is a contract between the policyholder and the insurer, where the insurer agrees to pay a designated beneficiary a sum of money upon the death of the insured person. The primary purpose is to provide financial support to dependents, covering expenses such as living costs, education, and outstanding debts.

What Is Life Insurance?

Life insurance is a contract between an individual (the policyholder) and an insurance company. In exchange for regular premium payments, the insurer promises to pay a lump sum of money — known as a death benefit — to designated beneficiaries upon the death of the insured person.

This financial cushion can be used to:

- Replace lost income

- Pay off debts (like a mortgage or car loan)

- Fund children’s education

- Cover final expenses such as funeral and medical costs

- Leave an inheritance or charitable gift

The Two Main Types of Life Insurance

When it comes to safeguarding your loved ones’ financial future, life insurance plays a crucial role. Yet, choosing the right type of life insurance can be overwhelming if you’re not familiar with the available options. Fortunately, most life insurance policies fall into two broad categories: Term Life Insurance and Permanent Life Insurance. Understanding the key differences between them will help you make an informed decision that aligns with your goals, budget, and stage of life.

Term Life Insurance

Term life insurance is the most straightforward and affordable form of insurance. It provides protection for a specific period—typically 10, 15, 20, or 30 years. If the insured person dies during this term, the insurer pays out the death benefit to the beneficiaries.

Key Features of Term Life Insurance:

- Fixed Duration: Coverage only lasts for the chosen term.

- Affordable Premiums: Term policies are generally less expensive than permanent policies because they don’t include an investment component.

- No Cash Value: Term life insurance is purely protection-focused. It does not accumulate cash value or offer a return on premiums paid.

- Level vs. Decreasing Term:

- Level Term: Death benefit and premiums remain constant throughout the term.

- Decreasing Term: Death benefit decreases over time, often used for specific debts like mortgages.

Who Should Consider Term Life Insurance?

- Young professionals seeking affordable coverage.

- Parents wanting to protect children until they’re financially independent.

- Homeowners with a mortgage to pay off.

- Individuals with temporary financial responsibilities or debts.

Permanent Life Insurance

Permanent life insurance provides lifelong protection, as long as premiums are paid. It also includes a cash value component that grows over time, offering a blend of insurance and investment.

There are several subtypes under the permanent life insurance umbrella:

This is the most traditional form of permanent insurance.

Features:

- Fixed premiums for life.

- Guaranteed death benefit.

- Cash value grows at a guaranteed rate.

- May earn dividends depending on the insurance company.

Ideal for:

- Individuals seeking stability and guaranteed returns.

- Estate planning or legacy-building goals.

UniversalInsurance

This policy offers more flexibility than whole insurance.

Features:

- Adjustable premiums and death benefits.

- Cash value growth is based on current interest rates.

- Can be tailored to changing financial situations.

Ideal for:

- Those who want lifelong coverage with adjustable terms.

- People with fluctuating income or changing needs.

Variable Life Insurance

This type includes investment options, allowing the policyholder to invest the cash value in mutual funds or similar instruments.

Features:

- Death benefit and cash value fluctuate with investment performance.

- Greater potential returns, but also higher risk.

- Requires active management and risk tolerance.

Ideal for:

- Experienced investors seeking higher returns.

- Those comfortable with market risk within their insurance plan.

Indexed Universal Life Insurance (IUL)

A hybrid option that ties the cash value growth to a stock market index (like the S&P 500).

Features:

- Gains based on market index performance.

- Usually includes a cap and a floor (limits on both growth and loss).

- Flexible premiums and death benefits.

Ideal for:

- Policyholders seeking moderate market participation without full exposure to risk.

Making the Right Choice

When choosing between term and permanent life insurance, consider the following:

- Budget: Term is more affordable and suitable for those needing high coverage with limited funds.

- Long-Term Needs: Permanent policies are ideal for those wanting lifetime coverage, wealth accumulation, or estate planning.

- Stage of Life: Young families often benefit from term life, while older individuals might prefer the lifelong coverage of permanent insurance.

- Goals: Whether you want just death protection or a combination of protection and investment determines your best option.

Blended Approach

Some individuals choose to combine term and permanent policies to balance affordability with lifelong protection. For example, you might buy a large term policy for temporary needs (like child-rearing or mortgage protection) and a smaller permanent policy for final expenses and legacy goals.als who want coverage that lasts a lifetime, along with potential for cash value growth.

Why Life Insurance Is Important

Many people mistakenly believe that life insurance is only necessary for those with dependents. In reality, it offers value in a variety of situations:

| Reason | Benefit | Who It Helps Most |

|---|---|---|

| Financial Security for Loved Ones | Provides a lump-sum death benefit to maintain family’s lifestyle | Families, spouses, children |

| Replaces Lost Income | Ensures continued financial support after the policyholder’s death | Breadwinners, dual-income households |

| Pays Off Debts and Final Expenses | Covers loans, credit card debt, and funeral costs | Family members, co-signers, estate executors |

| Estate Planning and Wealth Transfer | Transfers wealth efficiently; funds taxes or legal costs | High-net-worth individuals, estate planners |

| Business Continuity | Protects business operations; funds buy-sell agreements | Entrepreneurs, business partners |

| Supports Long-Term Financial Goals | Builds cash value for future borrowing or retirement needs | Savers, investors, those planning for retirement |

| Peace of Mind | Reduces anxiety about the future and unexpected events | Policyholders and their families |

| Affordable Protection | Low cost for high coverage, especially when young and healthy | Young adults, new families, budget-conscious individuals |

| Complements Other Financial Plans | Works alongside savings, investments, and retirement accounts | Anyone building a comprehensive financial strategy |

| Supports Families with Special Needs | Funds long-term care and support via trusts or large payouts | Parents of children with disabilities or lifelong needs |

How Much Life Insurance Do You Need?

Determining how much life insurance you need is a crucial part of financial planning. Too little coverage could leave your loved ones struggling, while too much might mean paying unnecessary premiums. The ideal life insurance amount should strike a balance between affordability and providing sufficient protection for your family’s current and future financial needs.

Key Factors to Consider

When calculating your life insurance needs, take a comprehensive look at both your current obligations and future financial goals. Consider the following categories:

Income Replacement

Think about how many years your family would need financial support if you’re no longer around. A common rule of thumb is 10 to 15 times your annual income, but this can vary based on your family’s lifestyle and financial habits.

Debt and Liabilities

Include all your outstanding debts:

- Mortgage

- Car loans

- Credit card balances

- Student loans

- Personal loans

The goal is to ensure these debts don’t become your family’s burden.

Daily Living Expenses

Estimate how much your family spends monthly on essentials:

- Rent or mortgage

- Utilities

- Food

- Transportation

- Childcare

Multiply these by the number of years you want to provide support.

Future Financial Goals

Plan for major future expenses:

- Children’s education (college tuition, school fees)

- Wedding expenses

- Retirement savings for your spouse

Final Expenses

Include costs for:

- Funeral and burial

- Medical bills

- Probate or legal fees

The average funeral costs between $7,000 and $12,000, depending on location and preferences.

Existing Assets and Insurance

Subtract:

- Your savings and investments

- Retirement accounts (IRAs, 401(k)s)

- Existing life insurance (e.g., through your employer)

This gives you a clearer picture of how much additional life insurance you need.

Simple Formula: DIME Method

Add these four categories together to get a rough estimate.

Example Calculation

Let’s say you’re a 35-year-old parent earning $70,000 annually with two kids and a mortgage.

- Income Replacement: $70,000 × 10 = $700,000

- Mortgage Balance: $200,000

- Other Debts: $20,000

- Children’s Education: $100,000

- Final Expenses: $15,000

- Total Need: $1,035,000

- Less Existing Savings and Coverage: $150,000

- Recommended Life Insurance Coverage: ~$885,000

Online Life Insurance Calculators

Many insurers offer online calculators where you input details like income, debts, number of dependents, and existing assets. These tools provide quick and personalized estimates.

Would you like me to walk you through a real-time calculation or suggest a calculator you can use?

Term vs. Permanent Insurance: Amount Matters Too

- Term life is best for high coverage amounts during key financial years (child-raising, mortgage period).

- Permanent life might offer a lower death benefit, but lasts a lifetime and builds cash value.

Some people buy a combination of both for flexibility — for example, a $1,000,000 term policy for 20 years and a $100,000 permanent policy for lifelong needs.

Common Mistakes to Avoid

- Underestimating future expenses, especially education or healthcare.

- Not reviewing your policy over time. Your needs change with marriage, home purchases, or children.

- Relying solely on employer-provided life insurance, which may not be enough and isn’t portable.

Common Life Insurance Terms to Know

- Premium: The amount you pay monthly or annually to maintain the policy.

- Death Benefit: The money paid to beneficiaries upon your death.

- Beneficiary: The person or entity who receives the death benefit.

- Cash Value: A savings component in permanent life insurance policies that grows tax-deferred.

- Rider: An optional feature you can add to a policy for extra coverage (e.g., waiver of premium, critical illness).

Choosing the Right Policy

To choose the best life insurance for your needs, consider:

- Your age and health

- Family and financial obligations

- Long-term financial goals

- Budget

Many experts recommend starting with term life insurance if you’re on a tight budget or only need coverage for a specific time. Permanent policies are more suitable for those seeking long-term wealth transfer or investment potential.

When Should You Buy Life Insurance?

The best time to buy life insurance is as early as possible, ideally when you’re young and healthy. This ensures:

- Lower premiums

- Better coverage options

- Financial protection for future obligations

Don’t wait for major life events like marriage or having a child. Planning ahead can save money and provide peace of mind.

Life Insurance Mistakes to Avoid

- Procrastinating: Waiting too long can lead to higher premiums or disqualification due to health issues.

- Underinsuring: Buying too little coverage might leave your family financially vulnerable.

- Ignoring policy reviews: Failing to update your policy can result in outdated beneficiaries or insufficient coverage.

- Relying solely on employer-provided life insurance: Group policies often offer limited coverage and may not be portable.

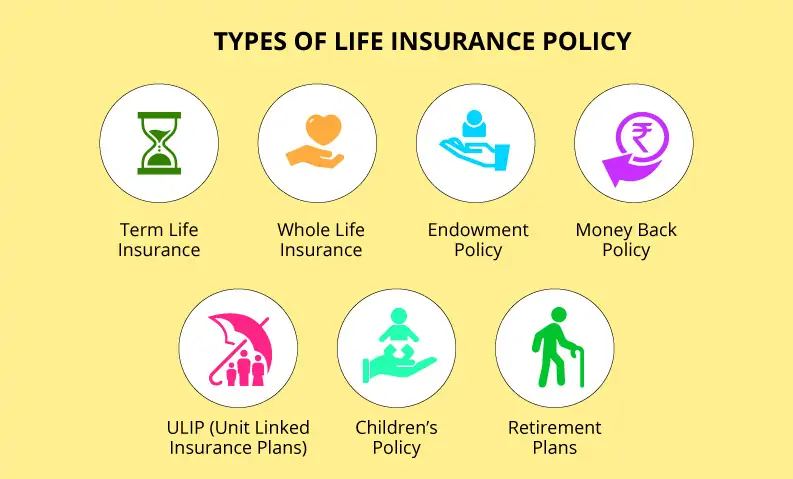

Types of Life Insurance Policies

- Term Life Insurance: This is a straightforward policy that offers coverage for a specified term, typically ranging from 10 to 30 years. It provides a death benefit if the insured passes away within the term but does not accumulate any cash value.

- Whole Life Insurance: Unlike term insurance, whole life policies offer coverage for the insured’s entire life, provided premiums are paid. They also accumulate cash value over time, which can be borrowed against or used to pay premiums.

- Universal Life Insurance: This type offers flexible premiums and death benefits. It combines a death benefit with an investment savings element, allowing the policyholder to adjust the coverage and premiums as their needs change.

- Variable Life Insurance: This policy allows the death benefit and cash value to vary according to the performance of investments chosen by the policyholder. It offers potential for higher returns but comes with increased risk.

Assessing Your Coverage

Having a life insurance policy is just the beginning. To determine if you’re truly protected, consider the following:

- Adequacy of Coverage: Does your policy provide enough to cover your family’s living expenses, outstanding debts, and future financial needs? It’s essential to calculate the total amount of coverage required and compare it with your policy’s death benefit.

- Policy Exclusions: Understand the exclusions in your policy. Common exclusions include death due to suicide within the first two years, death resulting from participation in hazardous activities, or death occurring while committing a crime.

- Premium Payment Terms: Ensure that you can consistently meet the premium payment requirements. Missing payments can lead to policy lapse, leaving your beneficiaries unprotected.

- Beneficiary Designations: Regularly review and update beneficiary designations to reflect life changes such as marriage, divorce, or the birth of a child.

Common Pitfalls to Avoid

- Underinsurance: Many individuals opt for minimal coverage to reduce premium costs, only to find that their policy doesn’t adequately cover their family’s needs.

- Overlooking Riders: Riders are additional benefits that can be added to a policy, such as critical illness or accidental death coverage. Neglecting to include them can result in insufficient protection.

- Failing to Review Policy Regularly: Life circumstances change, and so should your insurance coverage. Regularly reviewing your policy ensures it aligns with your current needs.

- Not Understanding Policy Terms: Insurance jargon can be complex. Take the time to understand the terms and conditions of your policy to avoid surprises when a claim arises.

Also Read: Are You Truly Protected by Your Life Insurance?

Conclusion

Life insurance is a vital tool for financial protection, but its effectiveness hinges on choosing the right policy, understanding its terms, and ensuring it aligns with your current and future needs. Regularly reviewing and updating your policy can provide peace of mind, knowing that your loved ones will be taken care of in your absence.

FAQs

- What is the difference between term and whole life insurance?

- Term life insurance provides coverage for a specific period and does not accumulate cash value, while whole life insurance offers lifelong coverage with an investment component that builds cash value.

- Can I change my beneficiary after purchasing a policy?

- Yes, beneficiaries can be changed at any time by submitting a request to the insurance company, provided the policyholder is mentally competent.

- Does life insurance cover accidental death?

- Standard life insurance policies may not cover accidental death. However, riders like Accidental Death and Dismemberment (AD&D) can be added for additional coverage.

- Are life insurance payouts taxable?

- In most cases, life insurance death benefits are not subject to income tax. However, if the policy has accumulated interest or dividends, those may be taxable.

- What happens if I miss a premium payment?

- Missing a premium payment can lead to a policy lapse. Some policies offer a grace period, but it’s essential to make payments promptly to maintain coverage.

- Can I borrow against my life insurance policy?

- If you have a whole or universal life policy with accumulated cash value, you may be able to borrow against it. However, loans accrue interest and reduce the death benefit if not repaid.

- Is life insurance necessary if I have no dependents?

- While not essential, life insurance can still be beneficial for covering funeral expenses, leaving a legacy, or paying off debts.